Early Solar forecast: First half 2026 solar outlook

Early Solar forecast: First half 2026 solar outlook

From:PV Magazine

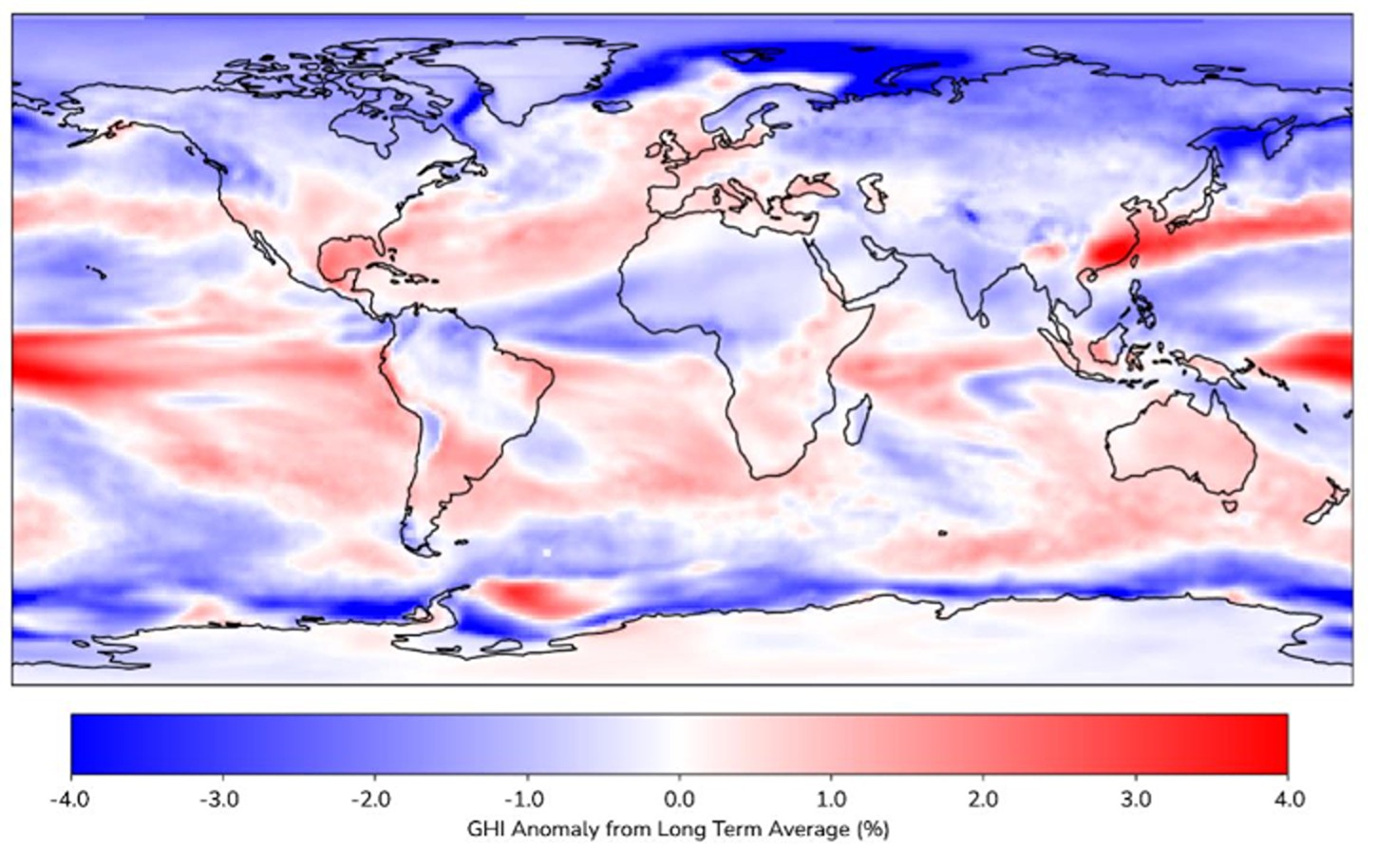

In a new weekly update for pv magazine, Solcast, a DNV company, reports that early 2026 will bring mixed solar conditions globally, with strong prospects in eastern Australia and eastern China, but cloudier-than-normal outlooks for much of Europe, Asia, and parts of the US early in the year.

Solcast

Image: Solcast

Share

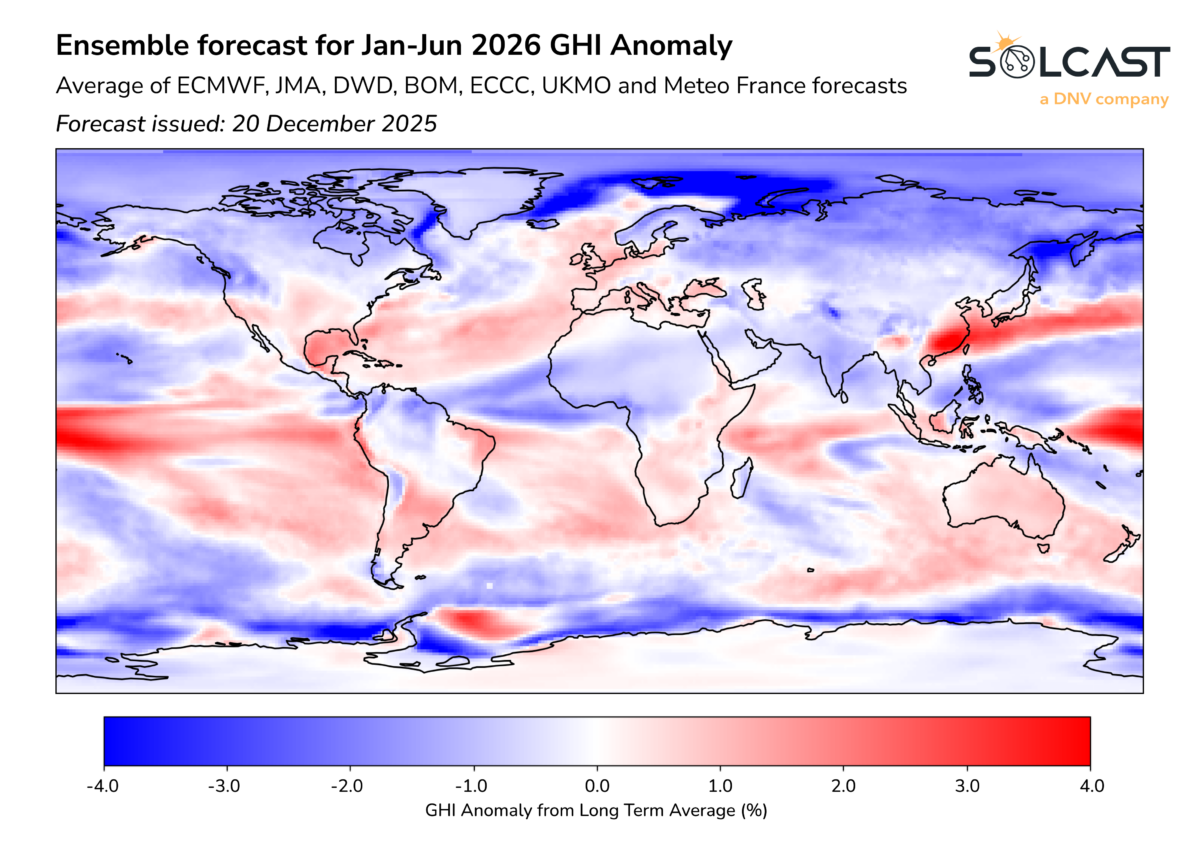

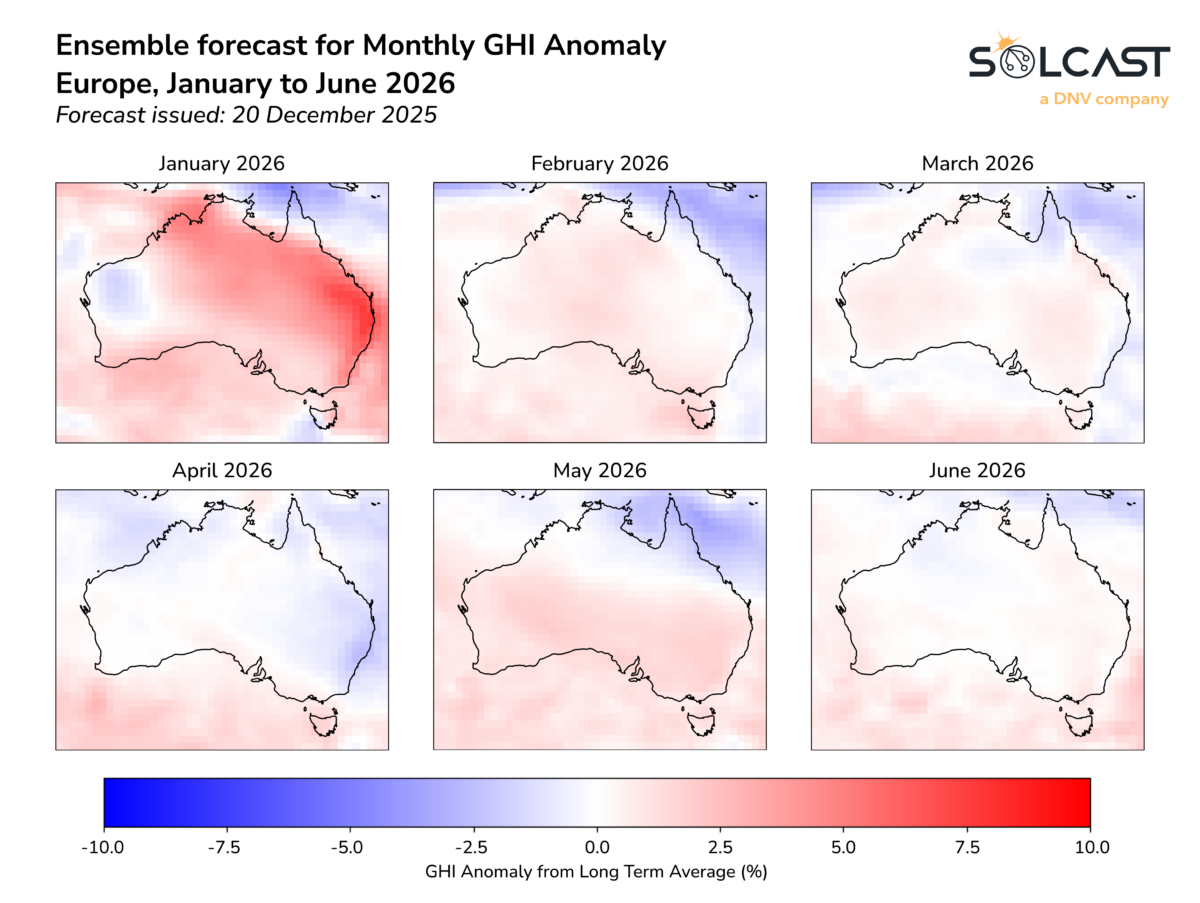

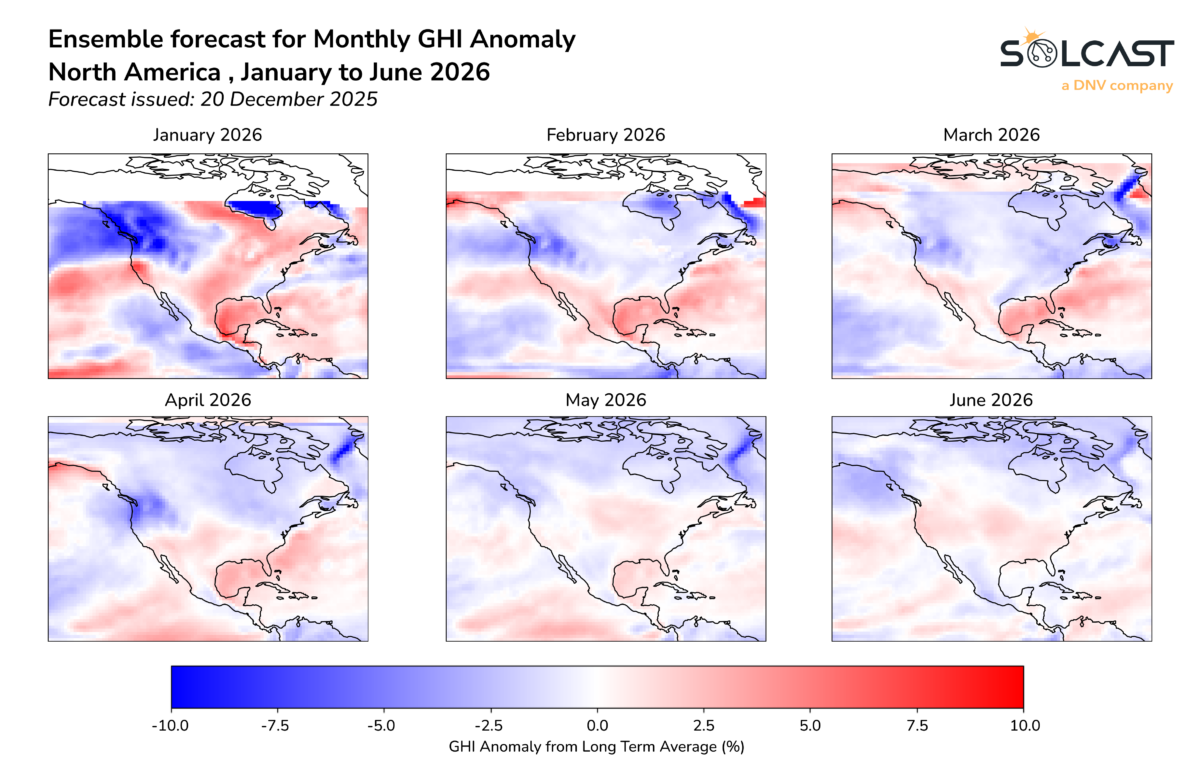

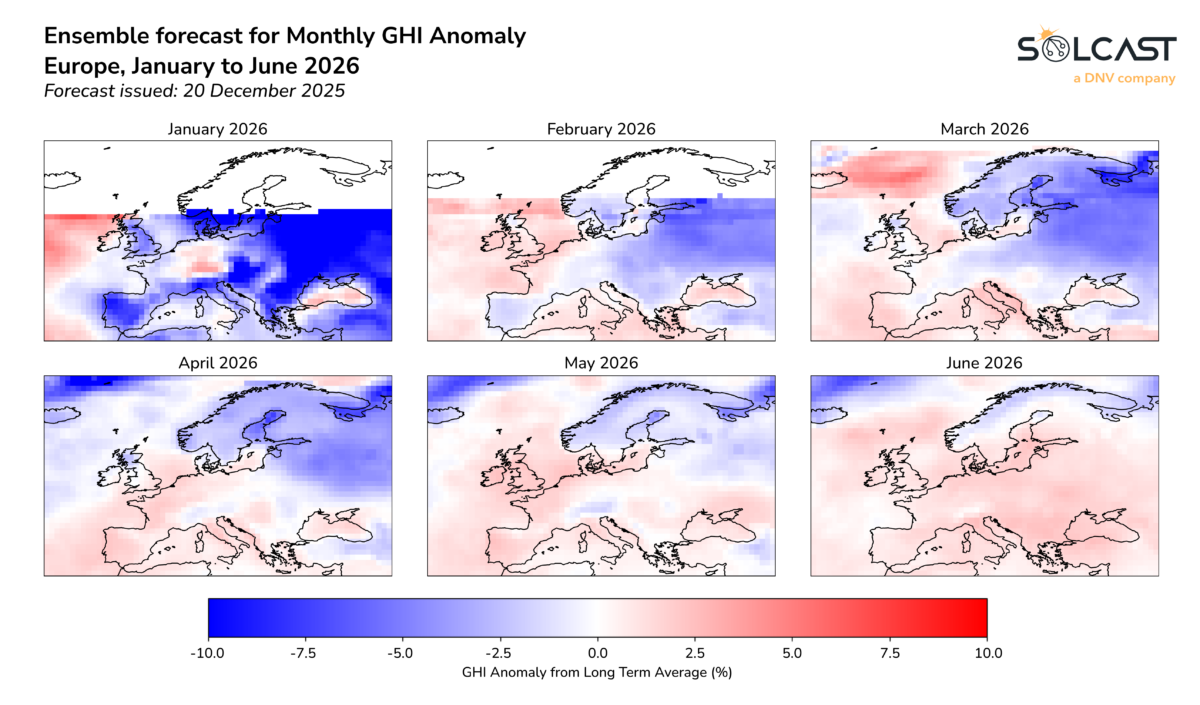

The first half of 2026 is shaping up to deliver a mixed solar outlook globally, according to analysis by Solcast data scientists. Seasonal forecasts from multiple weather agencies suggest a challenging start to 2026 for solar operators in Europe, but early signs of a sunny start to summer, with the opposite in the US with broad negative anomalies forecast for most of the US in February, March, and April after a strong January. Almost all forecasts suggest a first half of 2026 for Australia, including a particularly clear January for peak summer conditions and whilst most of Asia faces cloudier than normal conditions, Eastern China seems likely to benefit from clear conditions. ENSO variability adds further complexity, with neutral conditions expected early in the year before a possible shift toward El Niño later in 2026.

Eastern Australia and much of China stand out as clear winners in the ensemble forecasts. Both regions are projected to enjoy sunnier-than-normal conditions through most of the first six months, offering a strong start for solar operators. In Australia, consensus among models is unusually high, with nearly all months trending brighter than average. The exception is April, which is forecast to bring widespread cloudiness across the continent. Meanwhile, eastern China is expected to experience consistently elevated irradiance, in stark contrast to the rest of Asia, where forecasts suggest below average irradiance for the the first half of the year. Indonesia is forecast for some regions to see some months at or above normal, but otherwise most of East Asia – specifically Vietnam, Thailand, Philippines, and India are forecast for –1 to –5% negative anomalies for each month through to June.

Across the Americas, conditions vary sharply by region and season. North America begins the year strongly, particularly in January, though the Pacific Northwest bucks the trend with cloudier skies. California is forecast to avoid the heavier cloud cover predicted elsewhere, maintaining relatively favorable conditions. By midyear, approaching peak solar generating season, the southern United States and eastern Mexico are expected to outperform seasonal averages, with late spring and early summer contributing to the gains. This, plus increasing capacity year-on-year, makes it certain that each grid will see new solar records set throughout the year. Central America and much of Argentina and eastern Brazil also feature among the regions likely to see above-average irradiance early in the year.

Europe faces a challenging start, with eastern Europe and the Nordic countries projected to experience the most significant deficits—up to 10% below average—during the opening months. However, sunnier weather is anticipated as spring progresses, helping western Europe, excluding areas near the Alps, to finish the first half of the year on a positive especially as the days get longer into summer.

Northern Africa and parts of eastern Europe share a less favorable outlook, with persistent cloud cover limiting irradiance. Elsewhere, forecast confidence is lower, reflecting disagreement among models and the influence of evolving ENSO conditions. South America appears set for a cloudy January across the amazon and Northern Brazil, before settling into neutral or slightly positive conditions for most of the continent.

Solcast produces these figures by tracking clouds and aerosols at 1-2km resolution globally, using satellite data and proprietary AI/ML algorithms. This data is used to drive irradiance models, enabling Solcast to calculate irradiance at high resolution, with typical bias of less than 2%, and also cloud-tracking forecasts. This data is used by more than 350 companies managing over 300 GW of solar assets globally.